Finally! A Savings Hack That Really Works

Me and my wallet: rich in vinyl, brief on paper

There’s just no sexy way to say,”let us discuss that savings account.” It is a subject — and here I’m placing this yawnfest out there. The guts, right?

The matter is, setting money aside each week or month for a protracted time period is hard. I’ve tried all the tricks: to taking surveys, from moving money to the savings account mechanically, to saving my raises. I have also lived with ones and large paychecks.

The Elusive One-Way Savings Jar

What I need in life is a piggy bank that is one time. It is possible to drop the money in, but you can not get it out — at least without losing a finger or something extreme like that. Shattering piggy into a thousand pieces is not severe. Nor is becoming penalized for cashing out your bank CD early. Trust me, I have done both.

Up until recently, the only long-term strategy that’s worked for me is a healthful 401(k) contribution. I made a practice of placing the contribution percentage and a little higher than my comfort level. And I’d increase it anytime I got a boost.

While I did save a great chunk of change that way over the years, that money does not help me now. I can’t use it to cover my yearly HOA fees or even to pay off debt or buy clothing. And, now that I am a self-employed woman, the 401(k) piggy bank is closed. Which put me back to the custom of spending every dime I make — some on clothing for me and more on clothing for my own horse.

Since I Could Not Rig the Piggy Bank

Maybe I might have attempted a bank to chew my hands off, but that is seems extreme! I discovered an easier way to save. My savings hack and newest personal finance obsession is an app called Rize, and it has changed the way I manage cash.

If you are having difficulty putting away a bit, give Rize a look. If it works for you as it’s for me, you are going to be sitting on a savings balance this time . Use my link and you will get $5 deposited in your account just for signing up. (FYI, you may then make $5 for referring your friends. Just sayin’.)

The Way Rize Works

Rize is goal-based saving. You set up a target and a target date for this objective. So you’re familiar with how much you are saving often, you can correct the timeline. After that, link up your bank account with Rize and the savings occur automatically — Rize captures the money from your account and allocates it towards your goal(s).

You’re wondering why this differs from any savings account that is old. I had the exact same question. Here’s what’s better about Rize:

- You make a wholesome interest rate on your Rize equilibrium, 0.90% APY. That is, oh, about the national average.

- The money is tucked away from your regular checking and savings account. It’s possible to transfer it back whenever, however, the separation makes it easy to forget the money’s there.

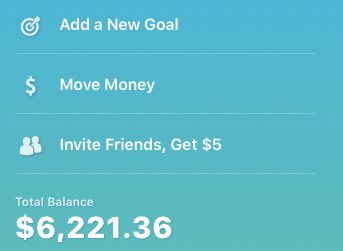

- You’re able to label modest pots of savings to get very specific items. I have four Rize goals right now, and I monitor my progress on every separately.

- You may earn $5 for referring your friends to Rize.

- You cannot pay bills or shop with your Rize funds, unless you move them back to your own bank accounts.

- You can opt in to save more with Rize Boost and Rize Accelerate. Rize Boost randomly scrapes change from your checking account. I use a couple of bucks a week and this adds up! Your savings increase by 1% each month.

How I Use Rize

I began using Rize earlier this year and I’ve saved over $6k. Go me! That is a whole lot inside a year, when I describe how it is used by me, but it is going to seem reasonable.

I’m utilizing Rize to store for:

1. Big invoices that just arrive yearly or quarterly: HOA, insurance, etc..

I truly dislike yearly bills like my HOA fees, car insurance, etc.. A person disciplined than me would save a little to ensure when those big bills arrive, the funds are ready to go. I’d consider doing this, but it never really worked out and I would wind up taking the money from my savings.

I set that money aside. I have not touched a cent of it so far.

2. A remodel loan that’s due in full next year.

An anticipated structural dilemma in the home prompted us to take out a loan to get the job done. We qualified for a”same as cash” deal for 12 weeks, which normally I’d run away from, screaming. Because if you owe 5 cents after the 12 months, then you get slapped with retroactive interest, I hate these deals.

With Rize, I am setting aside 1/12 of the entire balance each month. Because I earn interest on these savings, I am not likely to send a single payment to the lender before it is due in full. Without even spending a dime in interest, I’ll pay it off.

3. Additional spending money on holiday shopping and splurgy stuff.

Where the clothes budget comes from, this is. That I really do end up purchasing pieces two or even three times annually — although I don’t spend too much on clothes every month. Spring and fall are the offenders. In the fall, I stock up on sweaters and coats and sneakers. I would need a few dresses for weddings and other occasions and I feel my options to refresh.

Now that I am stashing money in Rize those wardrobe updates can be made by me without feeling guilty.

4. Emergency fund for unforeseen expenses.

The emergency fund is: monthly we set aside a bit. Itprevents us out of gutting our savings accounts when bad things happens,’s there for unexpected and, hopefully.

So that is the way I utilize Rize, my newfound savings hack. Do you have savings pitches? Let us know in the comments!

6 Ways to Help Your Guy His Style Game